If you want to cover all of your company’s vehicles and your employees with just one contract, fleet insurance for businesses is just right for you. In addition to less bureaucracy, you also benefit from lower rates compared to insuring your vehicles individually. In this article, you can find out more about the costs of fleet insurance, what advantages and disadvantages it offers and what points you should pay attention to before concluding a contract.

Inhalt

What is fleet insurance?

Fleet insurance is insurance cover for a fleet of commercially used vehicles with just one framework contract. This not only makes it easier to organize your commercial vehicle insurance, but ideally also reliably protects your company’s assets, vehicle contents and your employees. In addition, you benefit from significantly more services at more attractive conditions with a motor fleet insurance policy compared to individual policies.

Fleet insurance costs: What does fleet insurance cost?

The premium amount for commercial vehicle insurance for fleets depends on many factors. Among other things, the number of insured vehicles plays a significant role. The more company vehicles you insure, the greater the discounts you can negotiate for your fleet insurance. However, some providers have a maximum limit up to which they will insure the vehicles in a fleet. In principle, you should have at least three cars in your fleet in order to be able to take out fleet insurance.

It can be difficult to take out insurance for industries whose main business takes place on public roads. These include, for example, cab companies, courier services, car rental companies and care services. Due to the increased risk, cover for these vehicle fleets must be individually reviewed and calculated.

You can significantly reduce the cost of your fleet insurance by agreeing an excess of 150 euros or 300 euros for cars. An excess of 2,500 euros is standard for a truck. Although you will have to pay this amount yourself in the event of a claim, you will be rewarded with lower premiums overall.

Fleet insurance advantages: How do fleets benefit?

Compared to several individual policies, fleet insurance offers companies many advantages:

- Simplified administration: Instead of organizing separate policies for each vehicle, fleet insurance provides sufficient cover under a single policy, thereby simplifying the administration process considerably. Claims handling is also centralized. This helps you to manage your fleet efficiently.

- Cost efficiency: By taking out a single policy for all vehicles, companies can usually benefit from lower premiums. The deductible can also be adjusted individually, further reducing premiums when you insure your fleet.

- Flexibility: Fleet insurance can be adapted to the changing requirements of the fleet, such as a changing number of vehicles. Fleet insurance can also cover a wide range of vehicle types, such as cars, vans or special vehicles. This is often more difficult to manage with individual policies.

Disadvantages of fleet insurance: What fleets should consider

In addition to the numerous advantages, there are also various disadvantages of fleet insurance to consider. These include:

- Flat-rate premium costs: Premiums are often based on a flat-rate valuation of the entire fleet. This means that vehicles are assessed regardless of their individual use or risk profile. Vehicles with a lower risk may pay higher premiums through fleet insurance than if they were insured individually.

- Flat-rate premium increase: A single claim can drive up the premium payment for the entire fleet. In the event of an extensive claims history, this can lead to very high fleet costs .

- Dependence on one insurer: With fleet insurance, companies are tied to a single insurer. This makes them less flexible when looking for better rates or specialized cover options from other providers. In addition, some fleet insurance policies may not offer all the desired cover options that are available with individual policies.

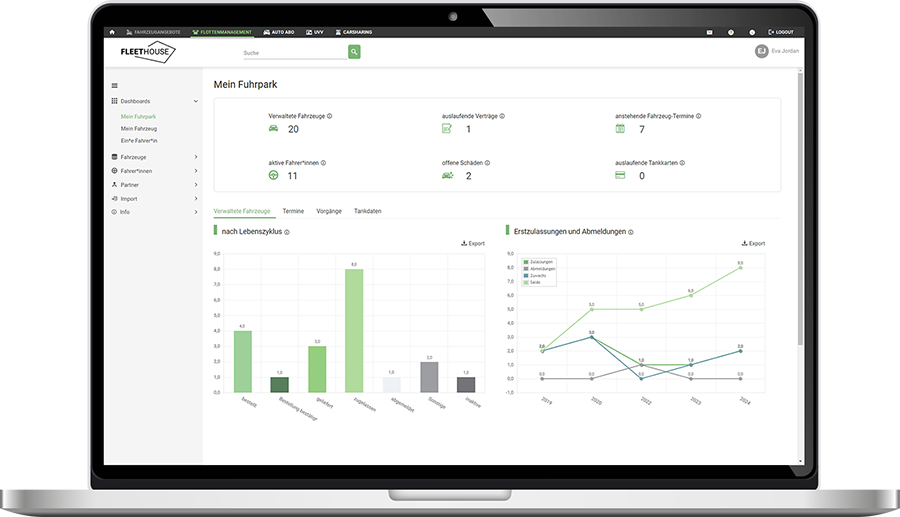

Digitalisieren Sie Ihren Fuhrpark

Organisieren Sie Ihre Fahrzeuge und sämtliche Versicherungen mit Fleethouse: Daten zentral verwalten, alle Termine im Blick behalten und Kosten überwachen.

What you should clarify before concluding a contract with the fleet insurance company

There is a wide range of fleet insurance on offer. To find the right cover for your company, you should check in advance whether you meet the relevant requirements for the number of company vehicles to be insured. The type of vehicles, the claims rate in the fleet and the industry also play a role.

For the right commercial vehicle insurance, we recommend clarifying the following questions in advance with the fleet insurance company. If your requirements are adequately covered by the insurance company, you are a big step closer to your fleet insurance . The next step is to choose the best policy from the wide range on offer.

What risks should your fleet insurance cover?

Theft, international journeys, long-distance journeys, injuries to passengers, breakdown assistance, legal costs – what is important to you? Bear in mind that the statutory liability insurance only covers third-party damage. If damage to your own vehicles and drivers is also to be insured, fully comprehensive insurance is required. You can arrange cover against fire and theft as well as injuries or damage caused by your own employees via additional agreements with the insurance company.

Are all fleet vehicles insured at all times?

If your fleet changes, you must ensure that the policy also applies here. For example, newly procured vehicles or lease returns may require adjustment. As a rule, the insurance provider must be informed of significant changes in good time so as not to jeopardize the insurance cover.

Are electric cars and hybrid vehicles sufficiently insured?

If you have electric cars or hybrid vehicles in your fleet, these are also covered by vehicle fleet insurance. However, make sure that both batteries and consequential damage are included in the scope of insurance. Typical hazards here include damage to the batteries as a result of accidents, operating errors or improper towing, as well as the theft of charging cables.

How can you reduce the cost of commercial vehicle insurance?

Among other things, the claims history of the vehicles, the type and number of vehicles, the size of the fleet and the desired scope of benefits play a role in the premium calculation. Costs can be reduced, for example, by additionally equipping the vehicle fleet with anti-theft systems or telematics systems (tracking systems). Some providers also reward the switch to lower-emission or electric vehicle models with reduced insurance premiums.

Does the insurance cover all drivers?

To this end, all driver-relevant information should be provided in advance and owner liability issues should be clarified within the company. Important to know:

- Drivers can usually only be included in the insurance cover from the age of 25.

- Employees who have been convicted of traffic offenses must be reported to the insurance company.

- If you have neglected to carry out and document the annual UVV driver training or the six-monthly driver’s license check , this can have consequences in the event of an accident. Anyone who drives without a driver’s license is putting the protection of commercial vehicle insurance at risk. In the event of a claim, motor third party liability insurers often claim back part of the claim costs, while partial and fully comprehensive insurers can refuse to pay out at all.

Useful additions for fleet insurance

The legally prescribed motor vehicle liability insurance is mandatory for every commercial vehicle fleet insurance. It covers damage to third-party vehicles and persons if an accident was culpably caused by a company vehicle. The statutory minimum cover amounts are 7.5 million euros for personal injury, 1.22 million euros for property damage and 50,000 euros for financial losses.

With most insurers, you can individually extend the scope of benefits with comprehensive insurance and other additional modules. An insurance advisor can help you find the best insurance cover. The following insurance products are available for commercial fleets:

Comprehensive car insurance

Brake, breakage and operational damage insurance

In addition to fully comprehensive insurance, this cover applies to damage that is not the result of an accident. This cover is particularly recommended for commercial vehicles in the vehicle fleet and if goods are transported frequently. Possible practical cases include vehicle damage caused by braking due to inadequate load securing or overloading. It also covers, for example, damage caused by failure of the safety technology, operating errors or technical driving errors.

Public liability insurance

If customer vehicles are also driven, it is advisable to take out business liability insurance. If an employee causes damage to a customer’s car in the course of their business activities, this is covered. Only in the case of gross negligence does the private liability of the person responsible take effect.

Motor legal protection insurance

Legal expenses insurance for fleet managers

In addition to their business management responsibilities, fleet managers also bear a great deal of legal responsibility when the duties associated with owner liability are delegated to them by the management. In the assigned function as vehicle owner, the fleet manager is jointly responsible for offenses committed by drivers and pool vehicle users. Legal expenses insurance covers the costs of defense in the event of criminal or administrative offence proceedings.

Car cover letter insurance

Company car contents insurance

Valuable tools, building materials or spare parts are popular stolen goods. Company car contents insurancetakes effect in the event of damage or loss. The parked vehicle is also insured here.

Webinar: Checklist for fleet management

In our free webinar, you will receive valuable tips on what to look out for when managing a vehicle fleet – from owner liability to the right form of financing.

Fleet insurance is also worthwhile for small fleets

Fleet insurance is also an interesting option for smaller vehicle fleets, for example for craft businesses, start-ups or self-employed people with a small number of company vehicles. They offer tailor-made fleet tariffs that are often cheaper than individual contracts and enable central fleet management – a clear advantage for companies with limited resources.

In addition, small fleets benefit from flexible arrangements such as the ability to easily add new vehicles or deregister existing vehicles. Some insurers even offer special discounts or premiums for small fleets, which enables additional savings. This means that even small companies can insure their fleets efficiently and cost-effectively. This makes it a good way to simplify administration alongside the use of fleet management software.

Private fleet insurance: Can private individuals take out fleet insurance?

Fleet insurance is specifically designed for companies or organizations that own and operate several vehicles commercially. As a private individual, you cannot usually take out fleet insurance unless you register the vehicles in the name of a business or other legal entity.

However, it is possible for private individuals with several vehicles in their possession to obtain similar insurance cover. Some insurance companies offer multi-vehicle policies or group policies for this purpose. These policies offer some of the administration and cost benefits of fleet insurance, but are specifically tailored to the needs of private individuals.

Sie wollen Ihren Fuhrpark effizient verwalten?

Registrieren Sie sich bei Fleethouse und managen Sie Ihre Firmenfahrzeuge komplett digital.

FAQ - Fleet insurance

Fleet insurance policies often specify who may use the insured vehicles. There are various models: either the group of drivers is restricted to certain persons or professional groups, or an open regulation applies in which any authorized person can use the vehicle. While an open driver regulation offers maximum flexibility, a restricted group of drivers can save costs as insurers can calculate the risk better. Companies should choose a policy that suits the daily use of the fleet while keeping an eye on insurance costs.

Insurance cover for your fleet usually begins on the date specified in the contract as soon as all the necessary documents have been submitted and the premium has been paid. Provisional cover is often granted as soon as the application has been submitted and accepted so that the vehicles can be used immediately. However, it is important to check the exact start date of the insurance cover in the policy conditions, especially in the case of last-minute changes or new vehicle additions. Talk to your insurer at an early stage to ensure seamless cover.

Fleet insurance typically covers various services that can be individually tailored to the needs of the company. These include motor vehicle liability insurance, which is required by law, as well as optional comprehensive insurance (partially or fully comprehensive) for damage to the company’s own vehicles. In addition, supplementary services such as cover letter services, passenger accident insurance, cover abroad or special services for electric vehicles can be integrated. Many insurers also offer flexible modules such as GAP cover for leased vehicles or cover against business losses following accidents. The exact benefits may vary depending on the provider and should be checked carefully to ensure optimum protection.

The most important facts about fleet insurance at a glance

With just one framework agreement, you can insure your entire fleet and all drivers without much effort and on favorable terms.

The basis of motor vehicle fleet insurance is statutory liability insurance. With the appropriate additional modules, you can extend your insurance cover to suit your individual needs.

The premiums for commercial vehicle insurance are always calculated individually. They depend on the number and type of vehicles, the claims history of the fleet and the type of commercial activity.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

Vehicle management: importance in the fleet and helpful tips

Fleet management without Excel: How to save time and money