Contents

What is a company car?

What are the advantages of a company car?

The company car offers advantages in many respects, both for employees and for companies:

Company car benefits Employees:

- Flexibility: For business trips, a company car makes it possible to get to the next appointment quickly and flexibly. Journeys are not tied to specific times, as is the case when using public transport.

- Save costs: If drivers are also allowed to use the company car privately, this saves the acquisition costs for a private vehicle. The employee only has to pay tax on the non-cash benefit. In some cases, the company also covers the fuel costs.

Company car Employer benefits:

- Employee retention and motivation: A company car can be a valuable incentive. In particular, if employees are also allowed to use the vehicle privately, it can help to increase employee motivation and loyalty.

- Operational mobility: Business trips can be made flexibly with the company car. This makes time management easier and ensures company mobility.

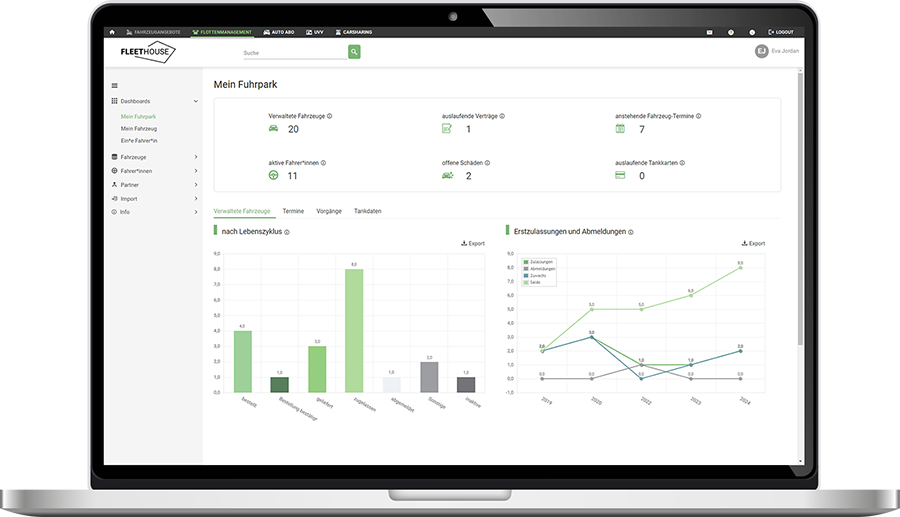

Digitize your fleet for just €2.90 per vehicle per month

What should companies bear in mind when providing company cars?

The use of company cars in the vehicle fleet is subject to certain rules. As the owner of the vehicle, the employer must comply with the corresponding obligations:

Holder liability

Owner liability in the vehicle fleet means that the vehicle owner can be held liable for any damage caused, regardless of who is at fault. Various legal obligations are associated with keeper liability in order to ensure safety in the vehicle fleet. As a rule, the employer or the management transfers these duties to the fleet management. This regulation also applies to company cars or company cars.

Among other things, the fleet manager is obliged to check the driving licenses of all drivers, as only employees with a valid driving license are permitted to drive a company car. A six-monthly check-up is recommended, or more often if necessary. You can use the Driving license checks can also be carried out electronically. This saves time and helps you to keep track of everything.

In addition, before using the company car, employees must be trained in the safe handling of the vehicle and how to behave in the event of an accident as part of a UVV driver training course. You must carry out this instruction once a year. You can also use the Fleethouse driver training as an e-learning course.

The vehicles must also be regularly checked for possible defects or damage as part of an accident prevention inspection. This is required by law and regulated in DGUV regulation 70 open_in_new. This inspection must be carried out by a competent person in order to ensure a professional assessment.

In the context of owner liability, it is crucial that the condition of the vehicles is checked regularly. In addition to the UVV inspection, maintenance intervals and inspections should also be precisely documented in order to ensure road safety and avoid legal risks. Particularly when using electric vehicles in the fleet, it should be checked whether charging facilities are functioning safely and faultlessly, as this also falls under the owner’s obligations.

Companies should also ensure that all drivers are trained in the correct use of vehicles in order to avoid accidents caused by improper handling. This responsibility always remains with the owner, even if the tasks are delegated to fleet management.

Instruct employees safely?

Train your drivers at least once a year in the safe handling of vehicles in accordance with UVV. The best way to do this is via e-learning.

Insurance

As the person responsible for the fleet, you must ensure that the company cars are comprehensively insured. The costs for the insurance are usually borne by the owner, in this case the company. At least one motor vehicle liability insurance policy is required by law. It insures against personal injury and property damage caused to others by drivers of the company car.

In addition, you can voluntarily take out partially or fully comprehensive insurance. Partial cover is liable for damage over which the driver has no influence. This usually includes damage caused by the weather, wildlife accidents or theft. Comprehensive insurance offers comprehensive cover in the event of an accident caused by the driver.

Extras such as driver protection insurance may also be relevant for company cars. Which insurance a vehicle needs depends on the individual vehicle type and type of use. It is important to compare different offers in order to choose the right one. Fleet insurance usually offers the most favorable conditions.

Car Policy

The car policy defines the conditions under which employees can use a company car. You should also specify criteria such as the equipment and price of the vehicle. Overall, it is about the general handling of company vehicles, which must be observed by all employees. Fleet managers and management have many options when designing these guidelines, as it is a catalog of criteria that is individual to each company.

A well-thought-out car policy not only takes into account the equipment and price of the vehicles, but can also include specifications on private use and taxation. Especially when choosing between classic models and electric vehicles, companies should make clear agreements that take both ecological and economic aspects into account.

In addition, the car policy can also stipulate the use of the logbook method to make it easier to distinguish between business and private journeys. This creates transparency and reduces possible uncertainties in handling. As part of the company guidelines, the car policy helps to ensure that all company vehicles are used efficiently and that legal requirements are complied with.

Claims Settlement

If an accident occurs with the company car, it is particularly important to settle the claim quickly. As the employer is usually the owner of a company car, the company is often liable in the event of an accident.

For private journeys, it depends on what is regulated in the car policy. Accidents should be reported and documented immediately . This facilitates the clarification of liability issues. The rapid provision of replacement vehicles for company cars reduces downtimes and the associated costs.

How is a company car taxed?

If the employee is also allowed to use the company car privately, they must pay tax on the resulting non-cash benefit. There are two different methods for this. The selected method must then be used for the entire calendar year.

Taxation using the 1 percent method

The first option is taxation using the 1 percent method. Private journeys are taxed monthly at a flat rate of 1% of the gross list price of the company car in Germany at the time of initial registration. The list price is the manufacturer’s recommended retail price. It is irrelevant whether the vehicle was purchased or leased and how old it is.

If the employee also uses the company car for journeys between home and work, these must also be taxed at 0.03% of the domestic gross list price per kilometer. However, anyone who drives their company car to work for less than 15 days a month only has to apply 0.002% of the list price.

As not every journey has to be recorded individually, the calculation of the 1 percent method is relatively simple and time-saving. The calculation method is based on the list price of the vehicle. The more expensive the vehicle, the higher the taxable amount. This can lead to tax disadvantages.

The flat-rate taxation with the 1 percent rule offers company car advantages for employees who frequently use the company car for private journeys.

Calculation example:

- Gross monthly income: 3000 euros

- New price of the company car: 35,000 euros

- Distance from home to place of work: 30 kilometers on 20 days per month

- 35000 Euro x 0.01 = 350 Euro

- 35000 Euro x 0.0003 x 30 = 315 Euro

- 350 Euro + 315 Euro = 665 Euro

The non-cash benefit amounts to EUR 665 and is counted as additional income to the salary. This increases the gross income to 3665 euros.

The logbook method

In order to determine the non-cash benefit of the company car more precisely, the employee can keep a logbook. This is particularly useful for employees who only make a few private journeys in their company car. All business and private journeys are recorded in the logbook.

The complete documentation of all journeys is particularly important here. For business trips, employees must document the date, time, mileage, destination and purpose of the trip and the names of the business partners visited before and after each trip. For private journeys, one kilometer is sufficient.

This method is significantly more complex than the 1 percent rule, but can prove to be tax advantageous in the long term. To simplify documentation, it is advisable to use an electronic logbook. The logbook method enables a more precise calculation of the non-cash benefit. This method can bring tax advantages, particularly for a small number of private journeys, as only the kilometers actually driven privately are taken into account.

It is important that the rules for keeping a logbook are clearly agreed in advance between the employer and employee. This applies not only to the type of documentation, but also to the use of electronic logbooks, which can significantly reduce the administrative burden.

Special features of electric company cars

Electrically powered company cars benefit from tax advantages. Instead of 1%, only 0.5% of the gross list price has to be taxed as a non-cash benefit. For electric cars purchased or leased by companies between December 31, 2018 and January 1, 2031, the following also applies: if the list price is less than €60,000, only 0.25% is taxed.

The future of the company car

Less effort

All company vehicles digitally at a glance with the fleet software from Fleethouse.

How are company cars managed correctly?

FAQ - Frequently asked questions about company cars

A company car is a vehicle that a company makes available to its employees for business purposes. It may often also be used privately, depending on the contractual agreement.

A transfer agreement regulates the conditions under which an employee may use a company car, including private use, assumption of costs and obligations.

The scope of private use depends on the individual agreement. This is often specified in the transfer agreement. For tax purposes, private use is taken into account using either the 1 percent rule or the logbook method. Using the logbook method enables precise recording of business and private journeys, which can bring tax advantages.

A logbook is a document in which all journeys made by a vehicle are recorded in detail. It contains information such as the date, mileage, start and destination as well as the purpose of the journey. Additional details, such as business partners visited, often have to be recorded for business trips. Among other things, it is used to distinguish between private and business trips, especially for tax purposes.

Arrange an online consultation appointment

Arrange your personal consultation appointment now. You can easily select a suitable appointment using our booking tool.

Anne Fuchs

Ciara Lazeta

The most important facts about company cars

A company car is a vehicle provided by the company for business purposes. In some cases, the employee may also use the company car for private purposes.

Owner liability, insurance cover and claims handling in the vehicle fleet are also relevant for company cars and must be taken into account.

Mobility budgets are an increasingly popular alternative to the classic company car with benefits for employees.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

Fuel cards for companies: Advantages, functions and tips for use

Company car configurator

Accident with company car: Who pays?

Leasing return checklist: How to return a company car

Further blog articles on the topic of company cars

The vehicle fleet at a glance: Importance, trends and technologies

Fleet management without Excel: How to save time and money

Basic areas of fleet management

Fleet management: basics and helpful tips

Measures for sustainable fleet management

Owner liability in the fleet: what fleet managers should bear in mind

Depreciation of cars, vans and trucks in the fleet

Returning company cars: when it is permissible and what you need to bear in mind

Financing models under the microscope: clever financing for company cars