If employees or self-employed persons use a company car not only for business but also for private journeys, a so-called non-cash benefit arises which employees must pay tax on. Taxing the company car correctly is a legal requirement. In this article, we explain which procedures are possible when taxing a company car and what you should pay attention to.

Contents

Why is it important to tax a company car correctly?

Correct taxation is very important for both the employee and the employer. Here are some reasons why:

- Legal obligation: If an employee also uses the company car privately, a non-cash benefit arises that is considered income for tax purposes. Incorrect taxation can have legal consequences such as additional tax payments, fines or even criminal prosecution.

- Avoidance of tax evasion: By correctly declaring and taxing the non-cash benefit, you act in accordance with tax law and avoid possible legal consequences.

- Avoidance of additional tax payments: In the event of a retrospective audit, the tax office may determine that the non-cash benefit was not sufficiently taxed and a corresponding additional payment must be made.

- Legal certainty for employees and employers. If the non-cash benefit is taxed transparently and correctly, there are no uncertainties or disputes with the tax office.

Taxing company cars taking into account the non-cash benefit

Company cars are not only used for business purposes such as business appointments, transportation or patient visits, but can also be used as an incentive for private use by the employee. This results in a non-cash benefit for the employee. The tax office regards this as a type of “salary component” that is relevant for tax purposes.

There are various methods of calculating and taxing the non-cash benefit of a company car. With the one percent rule (flat-rate taxation), one percent of the list price of the vehicle is taxed monthly as a non-cash benefit. Alternatively, a logbook can be kept in which the private and business journeys are recorded in order to determine the monetary benefit accordingly. The tax treatment of the non-cash benefit may vary depending on the country and legal situation.

Allocation of the company car to business assets:

Sole proprietorships or self-employed persons should clarify whether the vehicle is to be classified as business assets or private assets. If it belongs to private assets, each business trip must be accounted for individually. If the company car is part of the business assets, the private share is taxable according to the logbook or one percent rule.

Taxing company cars with the one percent rule

Taxation according to the one percent rule involves little effort, but can lead to higher tax payments as it does not take into account actual use. This regulation is based on the gross list price of the vehicle including VAT. Every month, one percent of this list price is calculated as a non-cash benefit and added to the salary, which increases the gross salary.

A similar calculation applies to company bicycles. Here, 0.25 percent of the gross list price is used as the basis. The non-cash benefit is lower for electric and hybrid vehicles. Employees who also use an electric car privately as a company car only have to pay tax on 0.5% or 0.25% of the gross list price per month.

If the company car is also used for journeys between home and work, an additional 0.03 percent of the list price per kilometer between home and place of work is deducted. If you use your company car for journeys between home and your first place of work, you can also deduct the commuting allowance as income-related expenses in the same way as for journeys in your own car. In the case of double housekeeping, an additional 0.002 percent per journey home and distance kilometer is added, provided the costs are not deductible as income-related expenses.

The one percent rule applies to purchased, rented or leased vehicles . leased vehicles. It is important to note that the one percent rule always takes into account the new value of the vehicle. This means that even if a used car is used as a company car, a percentage of the new value is taken into account. The one percent rule is therefore particularly advantageous if the value of the vehicle is lower and therefore a lower value is taken into account.

Advantages of the 1 percent rule

- Simple calculation and low administrative effort: the non-cash benefit is calculated on a flat-rate basis. Employees do not have to record journeys and keep records when paying tax on the company car.

- High cost certainty: The flat-rate calculation makes it possible to plan in advance how high the tax expenses will be. This provides certainty in cost planning when employees pay tax on the company car.

Disadvantages of the 1 percent rule

- Overtaxation for low usage: As actual usage is not taken into account, overtaxation may occur if the proportion of private usage is low.

- High tax burden for expensive vehicles: The non-cash benefit is based on the gross list price of the vehicle (including optional extras). This leads to high taxation, especially for high-quality cars with extensive equipment, even if the actual loss in value or benefit is lower.

- Unfavorable for older vehicles: The gross list price at the time of initial registration is used as a basis, even if the vehicle has lost a lot of value in the meantime. This can lead to a disproportionately high tax burden for older vehicles.

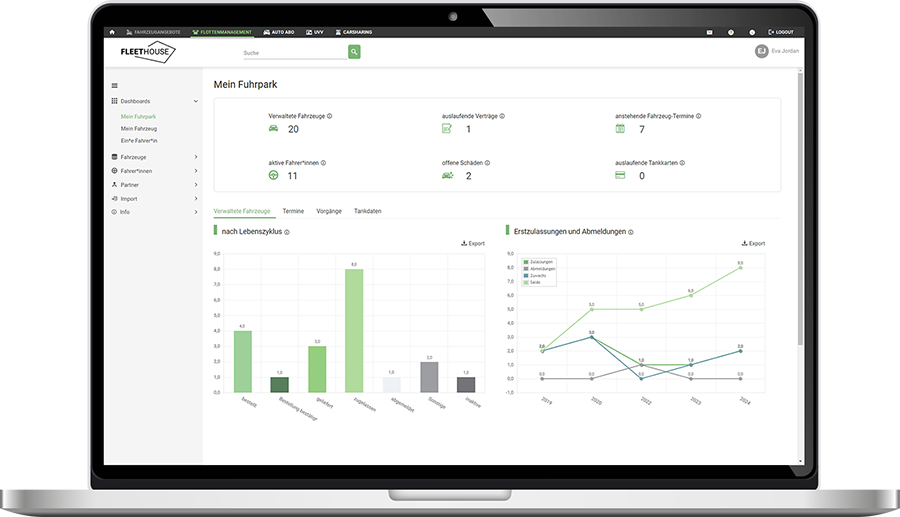

Do you keep an eye on your fleet?

Find out how you can manage your fleet efficiently with Fleethouse.

Taxing company cars with the logbook method

A logbook can also be used to tax the private use of a company car. The calculation of the non-cash benefit is based on the actual private use of the vehicle. In this case, the journeys made by the employee are recorded precisely and only the actual private journeys are taxed . If the company car is mainly used for business purposes and private journeys only make up a small proportion, the logbook method can lead to a lower tax burden.

The logbook can be handwritten or kept electronically. Certain details must be recorded in the logbook. For private journeys, it is important to note the kilometers driven, as these must be taxed. For business trips, the date, mileage at the beginning and end of the trip, destination, route, purpose of the trip, name of the business partner, etc. must be entered.

The logbook must be kept in full, in the correct chronological order and in a timely manner. The full costs incurred in connection with the company car, including annual depreciation or leasing expenses, are taken as a basis. If the tax office does not recognize the logbook, the flat-rate 1 percent rule is applied. It is therefore essential to keep a correct logbook in order to benefit from the advantages of low usage.

Tax advantages: Taxing electric and hybrid cars as company cars

In order to promote electromobility in Germany, the private use of these company cars is tax-privileged. For hybrid and electric vehicles, only 0.5% of the list price is applied and the non-cash benefit is therefore halved. If the gross list price of the vehicle is less than 95,000 euros, only 0.25 percent of the list price has to be taxed each month since July 2024.

This special regulation applies until the end of 2030 and saves the employee wage tax and the employer social security contributions. The prerequisite for hybrid vehicles is a maximum carbon dioxide emission of 50 grams per kilometer driven and an electric range of at least 80 kilometers. There are also tax benefits when charging the electric vehicle and for vehicle tax.

Prohibit private use of company car

If an employee uses a company car exclusively for business purposes, the company can deduct all associated costs and the employee does not have to pay any additional income tax. To avoid the tax office assuming private use, the employer and employee should agree in writing on a clear ban on private use of the company car.

In order to ensure that no non-cash benefit is taxed, the employee should either keep a logbook or be able to prove that the company regularly monitors compliance with the ban on private use, e.g. by signing or handing in the vehicle keys after work.

Do you want to give Excel the boot?

Register with Fleethouse and manage your company vehicles completely digitally.

FAQ - Frequently asked questions about the taxation of company cars

The taxation of a company car depends on its use: The one percent rule is uncomplicated and is suitable for proportionately high private use, as a flat rate of 1 percent of the gross list price is taxed. The logbook requires more effort, but is advantageous for predominantly business use, as only the actual private costs are taxed. A calculation or consultation will help you decide.

A vehicle is considered a company car if it is provided by the employer and used primarily for business purposes. Depending on the regulations, it can also be used for private journeys, which then counts as a non-cash benefit for tax purposes. The decisive factor is that the vehicle is owned or leased by the company and is primarily used to perform work-related tasks.

Even when working from home, journeys to the employer must be taxed if they take place. These are regarded as journeys between home and the primary place of work and are taxed either at a flat rate using the 1% rule or according to the actual kilometers driven using the logbook method. In the case of a pure home office, this taxation does not apply, as there is no travel to the employer.

The most important facts about taxing a company car

The one percent rule offers a simple calculation, but does not take actual use into account. The logbook method requires more effort, but can lead to a lower tax burden.

The correct taxation of a company car is crucial in order to avoid legal consequences.

Electric and hybrid vehicles can offer special tax benefits that are of interest to both employees and employers.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

E-car as a company car: taxes, costs and insurance

Company bike: advantages and taxation in the fleet

Further blog articles on the topic of company cars

The company car: advantages, challenges, future prospects

Leasing return checklist: How to return a company car

Car subscription: When a car subscription makes sense for your company

Accident with company car: Who pays?

Sample company car policy: clear regulations in the company

E-car as a company car: what to consider when it comes to taxes, charging costs and insurance