The claims ratio plays an important role in the vehicle fleet, as it has a direct influence on the insurance premiums to be paid. Fleet managers are therefore faced with the task of not only managing the company’s vehicle fleet efficiently, but also ensuring greater safety. In this article, we explain why it plays a major role in the fleet and how you can calculate and reduce the claims ratio.

Contents

What is a loss ratio?

The claims ratio is an important figure for insurance companies, as it shows the cost of claims in relation to the premiums paid by the policyholder.

Based on the claims ratio, the insurance company can check how much income was generated through premium payments and how much was spent on claims. It therefore influences future insurance premiums and defines how profitable a contract is for the insurance company.

The rule is: the higher the claims ratio, the higher the costs for the insurance company and the higher the premiums.

How do you calculate the loss ratio?

The calculation of the loss ratio is based on a simple formula. The total claims costs are divided by the total premium payments and the result is multiplied by 100.

Example: The total claims expenditure is 30,000 euros and the total premium payments amount to 70,000 euros.

Loss ratio = (30,000/70,000)×100 = 42.8 %

The loss ratio in this case is 42.8%. As a rule, a loss ratio of below 65% as very good as it indicates that the premium payments made significantly exceed the claims costs.

If the value is above 100%, the insurer cannot work cost-effectively. In this case, the insurance company will increase the premium payment or may even cancel the policyholder’s policy. Bear in mind that the claims ratio fluctuates over the course of the year and should therefore be recalculated regularly.

Calculate loss ratio: Relevant key figures

Various key figures are used to calculate the insurance premiums. These include:

Combined ratio: This ratio puts the total claims expenditure in relation to the premiums received. A loss ratio of over 100% means that costs exceed income and the insurance company is making losses.

Gross cost ratio: Also known as the operating expense ratio, this key figure puts administrative expenses in relation to the premiums collected. It provides an overview of how efficiently an insurer works in comparison to the premiums collected.

Gross loss ratio: This is the loss ratio presented in this article.

Safe on the road?

Reduce the risk of damage and instruct your drivers on how to handle vehicles safely and what to do in the event of an accident.

Reducing the loss ratio: 5 measures for the vehicle fleet

- Analyze damage frequency and causes: Look at previous claims and check whether there are clusters of damage at certain times, in certain situations or due to a certain driving style. Based on the results, you can minimize risk factors through appropriate training or vehicle equipment.

- Driver training: Invest in regular driver safety training and education for your drivers to improve their safe driving skills and awareness.

- Vehicle maintenance and inspection: Ensure that regular vehicle maintenance is carried out in accordance with the manufacturer’s instructions. Keep a detailed maintenance log for each vehicle type in the fleet to maintain an overview. Rely on qualified workshops and high-quality spare parts to ensure the longevity of your vehicles.

- Handling damage: Professional claims handling helps to keep downtimes and costs as low as possible. Clarify responsibilities and introduce clear procedures for damage reports, repairs and insurance matters.

- Insurance premiums: Negotiate with insurance providers to get the best terms for your fleet insurance and reduce potential claims costs.

Reduce loss ratio with the help of software

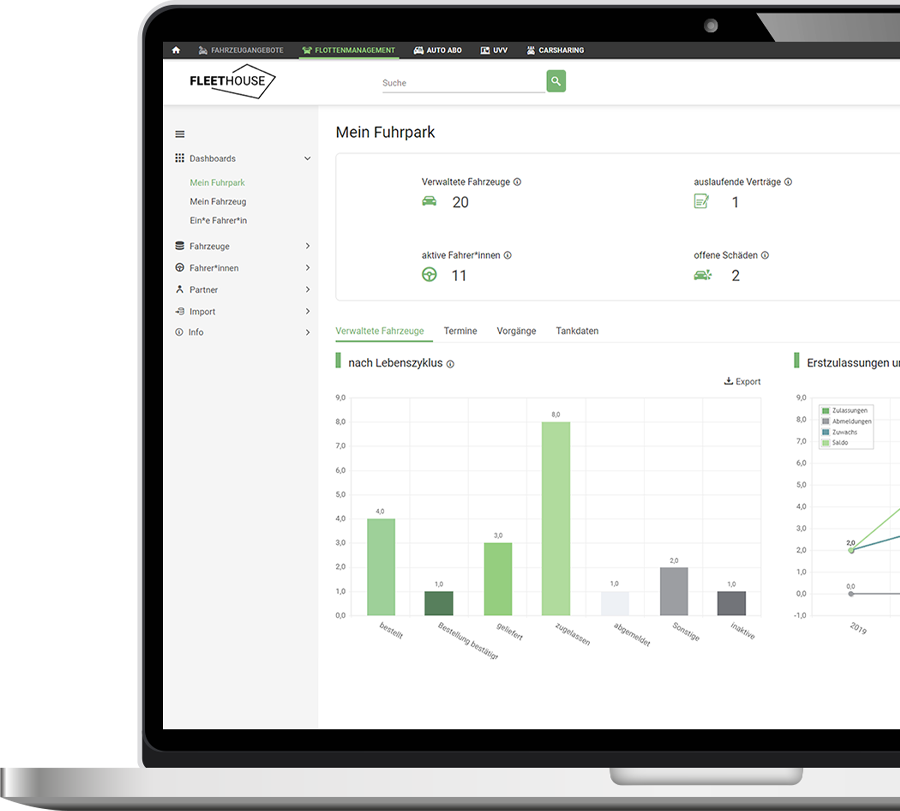

Fleet management software such as Fleethouse can help companies to reduce their claims rate. Claims are documented centrally and in a standardized way and can be evaluated in a targeted manner, e.g. with regard to the causes of accidents, costs and frequency of claims. Detailed reports show trends and patterns that you can use to take appropriate optimization measures.

With the fleet management software from Fleethouse, you can record and process claims clearly and transparently. Simply register and Test for 30 days without obligation.

Manage damage digitally

Fleethouse fleet management software allows you to keep an eye on the costs for each vehicle and receive targeted evaluations of damage to the fleet.

The most important facts about the loss ratio

The claims ratio is a very important key figure for insurance companies, in which the costs of claims are set in relation to the premiums paid by the policyholder.

A low claims ratio lowers the cost of insurance premiums and reduces the risk of termination by the insurance company.

With fleet software, you can identify the causes of damage and process claims more quickly.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

Claims management: The 1×1 for fleet managers

Fleet insurance for your vehicle fleet: this is what matters