The first step into self-employment has been taken and now a new company vehicle is to be purchased by means of company car leasing. Whether as a useful work tool or for a representative appearance – a professional impression on customers and interested parties plays an important role, especially for start-ups. Car leasing for start-ups offers an efficient and attractive mobility solution. For manageable monthly installments you get a stylish new car, liquidity is maintained and all vehicle and leasing costs are immediately tax-deductible.

At the dealership, both new entrepreneurs and small business owners are often dismayed to discover that the leasing bank has particularly high requirements for them in order to reliably secure the leasing loan. However, leasing for start-ups is not completely out of the question. In our blog post, we explain how car leasing for start-ups can still work out.

Contents

Leasing tips for start-ups

It is often more difficult for start-ups to conclude a leasing contract. This is because leasing companies consider the risk of non-payment to be particularly high for start-ups and therefore generally prefer business customers with a proven track record. As a founder, it is therefore usually necessary to provide the leasing company with sufficient collateral.

1. leasing for start-ups with down payment

In order to give the leasing bank the desired security, start-ups can make a higher down payment as a special leasing payment at the start of the contract. This is not a disadvantage, because the monthly leasing rate is lower as a result.

2. leasing contract for founders with guarantor

A bank guarantee from your bank, which is subject to a fee, or a private guarantor with a good credit rating can also serve as security for leasing for start-ups. If you still have a main job with a fixed income, you can also vouch for yourself.

3. vehicle leasing for start-ups through a deposit

If you pay a deposit, you also offer the lessor solid security. This usually amounts to 20% to 30% of the vehicle price and is repaid at the end of the leasing period or offset against possible repair costs in the event of damage.

4. car leasing for start-ups with black figures

Full-time entrepreneurs whose business has been on the market for more than half a year have an advantage. Creditworthiness can be assessed on the basis of existing business figures or confirmed by a corresponding bank report. If the leasing company is prepared to go to the effort of reviewing the business plan as well as obtaining a credit report, the chances of a leasing contract increase for start-ups too. An already functioning revenue model can also be beneficial.

If the required security can be offered to the lessor, leasing is also possible for start-ups.

Why is leasing particularly valuable for start-ups?

In principle, leasing is a good alternative to buying a new car for start-ups. Start-ups in particular benefit from this. They often face financial challenges in the early days, as many things have to be purchased from scratch. In addition to mobility, whether as a company car or commercial vehicle, commercial leasing also has many business advantages:

The capital requirement is reduced.

The leased vehicle only appears as a payment obligation in the income statement and not in the balance sheet. This has a positive effect on the equity ratio and protects the bank’s credit line. This preserves the creditworthiness of the business founder for other investments.

It offers more flexibility and liquidity.

With a short vehicle usage period and standard leasing terms of 12 to 36 months, the investment is manageable. The young company can use its valuable capital for more important things.

Leasing for start-ups is particularly interesting due to its economic advantages.

The financial risk is reduced.

The high initial investment for a new car is eliminated and replaced by fixed, predictable monthly installments. The technical and economic depreciation of the company car is irrelevant, the benefits of the manufacturer’s warranty can be optimally exploited and a mileage leasing contract shifts the residual value risk to the lessor.

Commercial leasing includes manufacturer or dealer conditions.

Small businesses and sole proprietorships can also take advantage of the reduced conditions for tradespeople when leasing a vehicle.

Lessees benefit from tax advantages.

Leasing installments, special payments, registration fees and similar costs can be immediately claimed as expenses. The only condition: The leased vehicle must be used at least 90% for professional purposes. If more than 10% of the vehicle is used privately, the costs are written off proportionately via the income surplus calculation (EÜR) and reduce the income tax payable.

Commercial leasing enables a professional and reputable appearance.

A prestigious new car is an important factor in attracting potential customers and business partners – especially in the start-up phase.

New vehicle at the click of a mouse?

Choose the right company car for your fleet from the wide range of leasing offers available immediately.

Our conclusion: car leasing is worthwhile for start-ups

Commercial leasing is an attractive financing option for many young entrepreneurs. In order to be recognized as a commercial customer, the self-employed activity must be carried out with the intention of making a profit, on one’s own account and on one’s own responsibility. However, the leasing bank will not play along without appropriate collateral and proof.

In any case, you will need: a copy of the current extract from the commercial register or business registration, a notice from the tax advisor about the type and start of self-employment, a notice of registration in a chamber or the professional register, a self-disclosure and more. Ultimately, however, the requirements of the respective lessor are decisive.

If the leasing bank says "NO": the car subscription

For founders who first have to overcome the financial challenges in the start-up phase and do not yet have sufficient income for leasing, we recommend the practical car subscription offers as a good alternative to commercial leasing.

These not only offer particularly short terms of three months or less, but also all-round carefree packages that already include all costs for insurance, tax, etc. Even if start-ups are not yet able to offer sufficient security, their mobility is secured by car subscriptions. And soon it will definitely also work with a leasing contract for business customers.

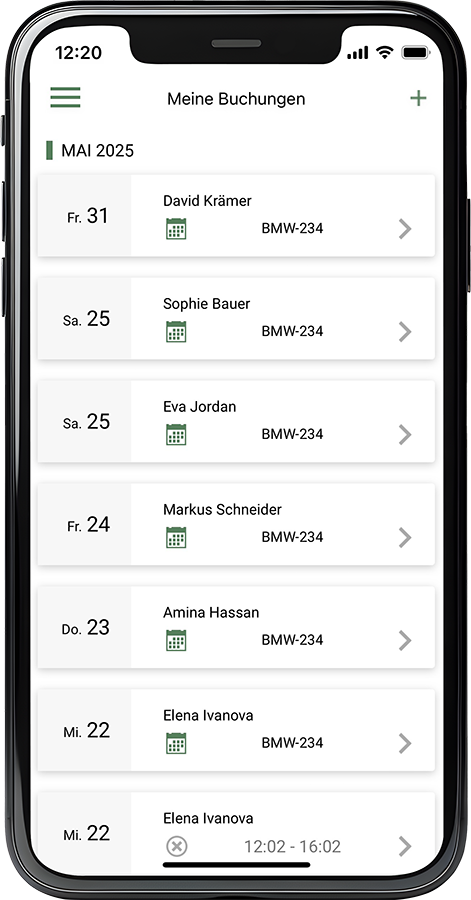

Car subscription module

Subscribe to the next company vehicle with Fleethouse. Together with FINN, we offer you an all-round carefree mobility package.

The most important facts about leasing for start-ups at a glance

Leasing for start-ups is an attractive alternative to a new purchase, as liquidity is maintained and costs are tax-deductible.

The prerequisite is that you provide the lessor with the required security.

Car subscriptions offer the necessary flexibility for start-ups without sufficient collateral.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

Leasing guide: Important aspects when leasing a company car