TL;DR

Damage management in the vehicle fleet means the complete handling of vehicle damage – from reporting and communication with the workshop and insurance company to repair and replacement mobility.

Targeted preventive measures (e.g. driver’s license checks, driver training, regular maintenance) can reduce damage rates and minimize downtimes.

A digital claims management solution automates processes, creates transparency through central claims files, speeds up processing and helps to reduce fleet costs in the long term.

Claims management is one of the most time-consuming tasks in a vehicle fleet. Many administrative and communication tasks must be taken into account in order to process claims correctly. Claims settlement can therefore take a lot of time and money, regardless of whether the damage was caused by your own fault or the fault of a third party. Fleet software helps you to process damage in a time and cost-saving manner. We will show you what claims management means and what you should bear in mind as a fleet manager.

What is claims management?

Contents

Efficient claims management includes all measures for handling damage to vehicles in the fleet. This includes communicating with insurance companies and garages, organizing repairs and providing a replacement vehicle for drivers.

The documentation of damage and repairs are also essential tasks for fleet management. Damage management in the fleet begins with the prevention of accidents and vehicle damage in order to minimize the risk of accidents in the long term.

As a fleet manager, you should be familiar with these terms in the area of claims management:

- Green insurance card: The green insurance card open_in_new serves as proof of insurance when driving abroad.

- Loss of use: If a company car cannot be used temporarily after an accident , this is referred to as loss of use.

- No-claims class: The no-claims class – also known as the SF class – shows how many years the insured person has driven accident-free.

- Loss ratio: The loss ratio is a calculation for insurance companies. The costs of claims are set in relation to the premium payments. A high claims ratio leads to a higher insurance premium.

- Accident report: Some accidents require an accident report, which is prepared by a motor vehicle expert.

- Excess: A certain amount that the company must pay itself in the event of a claim before the insurance will cover it.

- Damage history: The record of damage that has occurred to the vehicles in the fleet over time.

Claims management: What are the causes of vehicle damage?

Defects in the fleet can be caused by a variety of factors. The most common causes include traffic accidents, which are often due to human error, difficult weather conditions or confusing traffic situations. Vandalism, theft or willful damage can also lead to damage to company vehicles.

Another cause of defects in the vehicle fleet is wear and tear caused by a lack of maintenance and intensive use. Natural events such as hail, storms or flooding are also frequent triggers and present companies with additional challenges. Systematic damage management helps to analyze the causes and take preventive measures.

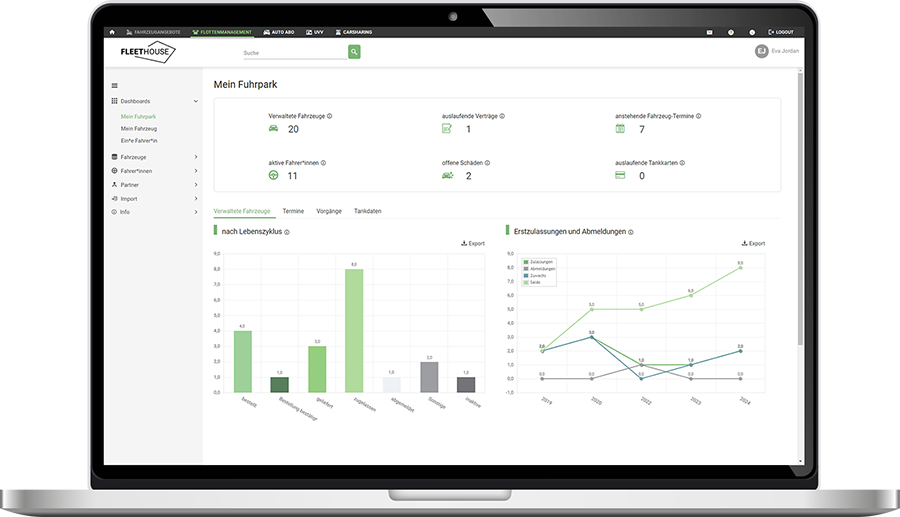

Fleet management for just €2.90 per vehicle per month

Record all relevant data on damage to your vehicles

Avoid damage through prevention

The tasks of a fleet manager in the area of claims management are very complex. Effective claims management begins before damage or defects occur to the vehicle. Many types of damage can be avoided by taking targeted measures in advance. Accident damage in particular can be significantly reduced by taking proactive steps:

- Regular driving license checks: Checking driving licenses ensures that all drivers have a valid driving license. This measure promotes road safety and reduces the risk of accidents by reducing the risk of unsuitable drivers. An electronic driver’s license check can simplify the process and relieve fleet managers of their tasks.

- Comprehensive driver training: Targeted driver training is a central component of the accident prevention regulations(UVV) and also serves to settle claims. The annual UVV driver training ensures that all drivers are familiar with the safety regulations, the operation of the vehicles and the correct behavior in dangerous situations. Regular instruction in accordance with UVV reduces the risk of accidents, as drivers are trained to recognize hazards at an early stage and to act responsibly.

- Maintenance of company vehicles: Technical defects such as broken brakes or worn tires are among the most common causes of accidents. Regular vehicle maintenance ensures that critical components are checked and repaired in good time before they become a safety risk. This prevents potential damage and increases the reliability of the fleet.

- Measures in the event of weather risks: Difficult weather conditions such as black ice, snow or heavy rain significantly increase the risk of accidents. This risk can be significantly reduced through preventative measures such as driving training in adverse conditions and early conversion to winter tires . Drivers should also be encouraged to drive slowly and with foresight in extreme weather conditions in order to avoid damage.

- Tire management: Worn or incorrectly inflated tires increase the risk of accidents, especially in wet and slippery conditions. Regular checks of tread depth and tire pressure ensure that vehicles are always safe on the road. Early detection and rectification of problems significantly reduces the risk of tire damage or loss of control on the road.

Free guide

In our guide, you can find out more about keeper liability in the vehicle fleet – from the legal basis to the most important obligations.

Claims settlement in the vehicle fleet

Accidents and damage to vehicles cannot always be prevented. If damage has occurred, action should be taken immediately. Only a well-structured claims settlement process can help to ensure mobility within the company and avoid unnecessary costs. We have summarized below what fleet managers should bear in mind when settling claims:

Claims Settlement

Accidents should be reported immediately to ensure efficient claims management. With insurance and a suitable insurance policy, damage can be covered to a large extent and the costs remain within reasonable limits. It is important that all relevant information, such as the course of the accident, persons involved and damage, is documented immediately and included in the report to the insurance company.

Ensuring mobility within the company

In the event of damage or an accident, replacement vehicles should be available to drivers as quickly as possible, as vehicle defects can have a major impact on operational processes. This prevents downtime, meets deadlines and saves considerable costs .

Repair of vehicles

Once the damage has been reported and the insurance company informed, the repair should be carried out quickly and professionally in order to minimize downtime. In many cases, insurers work with authorized repairers who will repair the damage according to the insurance company’s specifications. You should make sure that the cost estimates are checked and approved by qualified experts and that meaningful photos of the condition are available. A prompt and high-quality repair not only ensures the safety of the vehicle, but also helps to prevent further consequential damage.

Documentation in claims management

Damage to the vehicle should always be appropriately documented as part of claims management. In this way, legal problems can be avoided and liability issues can be clarified more easily. Damage and the resulting costs should then be evaluated in order to identify high cost drivers and common causes of damage.

What is digital claims management?

Digital claims management refers to the use of software solutions and IT applications to digitally handle the and optimize the process of reporting, processing and settling claims digitally. and optimize it. Claims management software not only speeds up processes and ensures greater efficiency, but also creates more transparency and helps to minimize fleet costs. This means that the vehicles are quickly ready for use again and costly downtime is reduced to a minimum.

Fleet Management

Manage all tasks relating to your vehicles and handle damage with ease.

The benefits of digital claims management: How does claims management software help?

Damage management software significantly relieves fleet managers of time-consuming, manual work steps. Not only recording and documenting damage, but also communicating with workshops, insurance companies and employees takes up a lot of time in day-to-day fleet operations. This is precisely where a digital solution comes in and offers a multitude of advantages.

Automated processes

In the event of damage, action must be taken particularly quickly. Long downtimes have a negative impact on business success and reduce efficiency throughout the company.

With a software solution, many manual steps in claims management, such as the recording, prioritization and forwarding of claims reports, are automated, automated. Claims can be reported quickly and easily and forwarded to the fleet manager . Digital claims management saves a lot of time in the fleet and helps to reduce costs.

More transparency in claims management

All documents, whether expert reports, cost estimates, invoices or photos, are collected in a collected in a digital claims file. Such a central, digital database ensures that all relevant data and information on a claim is stored in one place. This facilitates access and ensures that everyone involved has access to the same information. This also makes it easier to track and check the information.

Reduce costs

By automating processes and improving communication – both internally and with external parties – the processing time for claims can be significantly reduced. This in turn leads to to shorter vehicle downtimes of vehicles and therefore lower costs for the company.

Digital claims reporting

Digital loss prevention

Training drivers in the correct handling of vehicles and an anticipatory driving style is part of claims management. It increases safety in the fleet and can minimize the risk of damage and accidents.

With a digital solution, you can carry out UVV driver training via an e-learning course. Instead of organizing classroom training, company car drivers can complete the course flexibly online, regardless of whether they are on the road, at home or in the office. The content is already compiled and ready to use.

To ensure that no training is forgotten, fleet management and employees are notified of upcoming and overdue dates by e-mail. All inspections carried out are stored in a complete and traceable mannerso that you have the relevant proof, especially in the event of a claim.

Arrange an online consultation appointment

Arrange your personal consultation appointment now. You can easily select a suitable appointment using our booking tool.

Anne Fuchs

Ciara Lazeta

FAQ - Frequently asked questions about claims management

Damage management refers to the entire process of processing and settling damage that occurs to vehicles. It includes the rapid reporting of damage, assessment of the extent, communication with insurance companies and the organization of repairs.

First of all, it is important to report the incident immediately and collect all relevant information – this includes photos of the damage, a detailed description of the incident and the type of damage and the contact details of all parties involved. In addition, the incident should be documented and the insurance company notified. The fleet manager must then ensure that the affected vehicle is ready for use again as quickly as possible.

A strong focus on prevention not only ensures driver safety, but also protects against unnecessary repair costs and insurance claims. In the long term, effective damage prevention helps to keep operations efficient and cost-effective and reduce the risk of business interruptions.

The most important facts about claims management at a glance

Claims management is one of the most important tasks in a vehicle fleet, as it can reduce costs and ensure that fleet operations run smoothly.

With the right damage prevention, such as UVV driver training or regular vehicle inspections, potential damage can be averted in advance.

Digital claims management ensures that data is recorded quickly and claims processing is accelerated. This saves time and costs in fleet management.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

Claims handling: A guide for fleet managers

Loss ratio: definition and calculation

Further blog articles on the subject of damage and vehicle fleets

Fleet Manager: Tasks, Qualifications and Salary

Leasing return damage: tips for a smooth process

Fleet management: basics and helpful tips

Fleet at a Glance: Importance, Trends and Technologies

Leasing return checklist: Successfully return a company car

Fleet management without Excel: How to save time and money

Fleet management: How to manage your vehicles efficiently

Fleet app – how to manage your fleet digitally and efficiently