A vehicle fleet is essential for many companies to ensure smooth operations. When purchasing vehicles such as cars, vans and trucks, it is important to know the depreciation rules, as these are mandatory. This article covers the most important aspects of depreciation for cars and other vehicles in the fleet. We also give you a comprehensive overview of the applicable regulations.

Contents

Car depreciation: what does it mean?

Depreciation is an essential part of the tax treatment of company vehicles. Depreciation is the loss in value of long-term assets over time. Depreciation is spread over the useful life and should realistically reflect the actual value of the asset and the profit. It should also have a tax-reducing effect.

Vehicles are depreciated on a straight-line basis, i.e. the value of the vehicle is distributed evenly over its useful life. The useful life of the vehicle plays a decisive role here. The amount of depreciation depends on the purchase price and the useful life of the vehicle.

How is depreciation calculated?

The acquisition costs of the company car are made up of the purchase price, ancillary acquisition costs such as transfer costs and special equipment less discounts or rebates. If input tax can be deducted, VAT does not play a role in depreciation. Otherwise, it must be included in the acquisition costs.

The useful life of a car can vary and depends on various factors, such as the type of vehicle and its use. As a rule, however, a useful life of between 5 and 10 years is assumed. The standardized depreciation table in Germany (AfA) generally provides for a useful life of 6 years for cars. This means that the car is fully depreciated in the company’s books after 6 years. However, it should be noted that the actual useful life of a car may vary depending on individual circumstances.

With a useful life of 6 years, this results in straight-line depreciation of 16.67% per year of use, which can be recognized as an operating expense. In individual cases – if the vehicle is used more than 90% for business purposes and other tax requirements are met – a special depreciation allowance of 20% can be claimed in the first year.

The depreciation table provides for a useful life of 9 years for vans, trucks and tractors and 11 years for trailers.

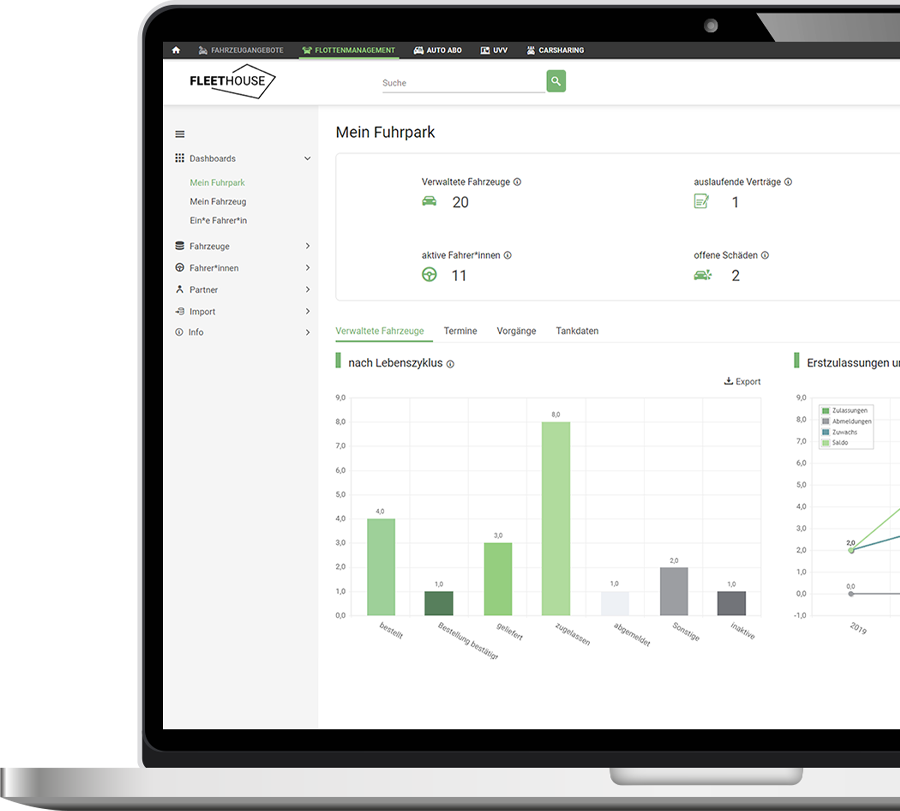

All vehicle costs always in view

The fleet management module gives you an overview of all fleet costs.

Depreciation of passenger cars: Used vehicles

The useful life of six years also applies to used cars. Age influences depreciation and enables higher depreciation rates:

- A two-year-old vehicle still has a remaining useful life of four years and can be depreciated annually at 25% .

- After three years, the remaining useful life is three years and depreciation increases to 33%.

- For vehicles over four years old, a remaining service life of two years is assumed.

- From the age of six years, 50% of the purchase price can be depreciated annually.

The higher depreciation generally offsets the lower purchase price and any higher repair or service costs for older vehicles.

Depreciation of commercially used electric vehicles

The tax treatment of electric vehicles in fleets has been changed in recent years to promote electromobility. Since 2020, companies have been able to claim increased depreciation for commercially used electric vehicles. This amounts to 50% of the acquisition costs and can be claimed in addition to regular depreciation. The depreciation period for electric vehicles is currently generally six years. It is important to find out about the current regulations and subsidies in order to make the most of the tax advantages of electric vehicles.

Sale and early depreciation of vehicles

In some cases, it may be necessary to sell a vehicle from the fleet or write it off early. This may be the case, for example, if a vehicle can no longer be used economically or is no longer part of the fleet. In the event of a premature sale or write-off, the current book value of the vehicle must be taken into account. On sale, the sales price achieved is compared with the book value and the profit or loss is treated accordingly. Premature depreciation also applies if the vehicle is removed from the business assets, e.g. due to an accident or theft.

Private use of a company car: 1% rule and logbook

In the case of private use of a company car, the non-cash benefit is offset against the depreciation. A common method for calculating the non-cash benefit is the so-called 1% rule.

Every month, 1% of the gross list price of the vehicle is taxed as a non-cash benefit. Alternatively, a logbook can be kept to document the actual private use of the vehicle.

This requires a precise record of all journeys and their purposes. It is important to choose the most favorable method for the company in order to optimize the tax burden.

The alternative to buying a car: leasing vehicles or car subscription

With leasing, the lessee only pays for the use of the vehicle; the car itself remains the property of the lessor. This means that no depreciation is due and the lessee only pays a monthly fee, which is deductible as operating expenses. This protects the lessee’s liquidity and enables the use of a new car, even if the entire capital for the purchase price is not available. The amount of the leasing installments depends on the contract term, the mileage and any service packages. If you want to opt for a very flexible model, you can try a car subscription, where terms often start from one month and there is a large selection of models available at short notice . Read more about which form of financing may be suitable for you here.

Car subscription module

Subscribe to the next company vehicle with Fleethouse. Together with FINN, we offer you an all-round carefree mobility package.

Car depreciation: accounting and tax documentation

Correct bookkeeping and tax documentation are crucial for the correct treatment of the depreciation of vehicles in the fleet. It is advisable to carefully keep all relevant documents such as purchase contracts, invoices and logbooks. In this way, acquisition costs, useful life and depreciation amounts can be accurately tracked. Professional bookkeeping can help you keep track of vehicle depreciation and make the most of tax benefits .

The most important facts about the depreciation of cars, trucks and vans

Acquisition costs, useful life and vehicle type determine the amount of depreciation.

The non-cash benefit arising from the private use of company cars can be taxed using the 1% rule or a logbook.

Proper accounting and documentation are crucial for tax benefits.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

Car subscription for electric cars: everything you need to know