Commercial leasing with Fleethouse Working for you

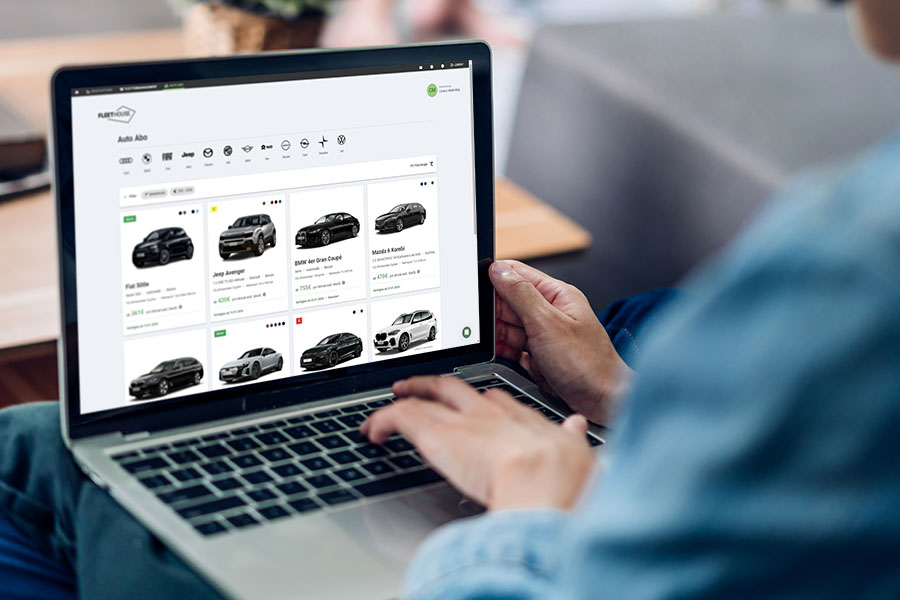

A new company car in just a few clicks? No problem with Fleethouse. Simply select the right company car for your fleet from the large number of leasing offers available immediately.

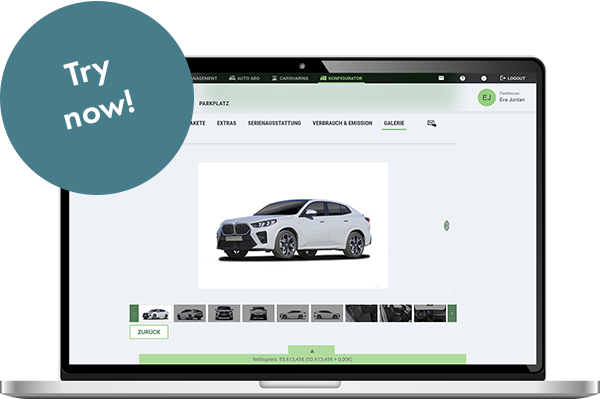

Design your own company car:

Try it out now:

Company car configurator

Don’t want to wait? Then simply configure your vehicle yourself! With the free company car configurator from Fleethouse, you can select and compare the desired specifications directly – from the vehicle model to the various equipment options. The automatic buildability check ensures that the vehicle can be ordered. Configure your dream vehicle now.

Digital commercial leasing: Company car leasing at the click of a mouse

The Fleethouse fleet platform makes company car leasing child’s play. Register free of charge and compare a wide range of attractive commercial leasing offers. Have you found a suitable leased vehicle? Then you can order it with one click. Our partners will take care of the transfer of the car for you. This means you can always equip your fleet with the latest models. And the conditions? With Fleethouse you benefit from attractive financing conditions.

Why you should rely on Fleethouse: What the commercial leasing module can do

Delivery times too long?

Choose from a wide range of immediately available stock vehicles

Opaque ordering process?

The entire order is processed digitally and transparently

Tight budget?

Attractive financing conditions protect liquidity

Older vehicle fleet?

Current vehicle models for the modern fleet

Digital commercial leasing with Fleethouse offers you many advantages: Everything is handled online, from comparing offers to signing the contract. Fleethouse also makes it easier for you to compare and select the best offer. This saves time and speeds up processing. Do you have questions about a leasing offer? Then you can contact the retailer at any time using the chat function.

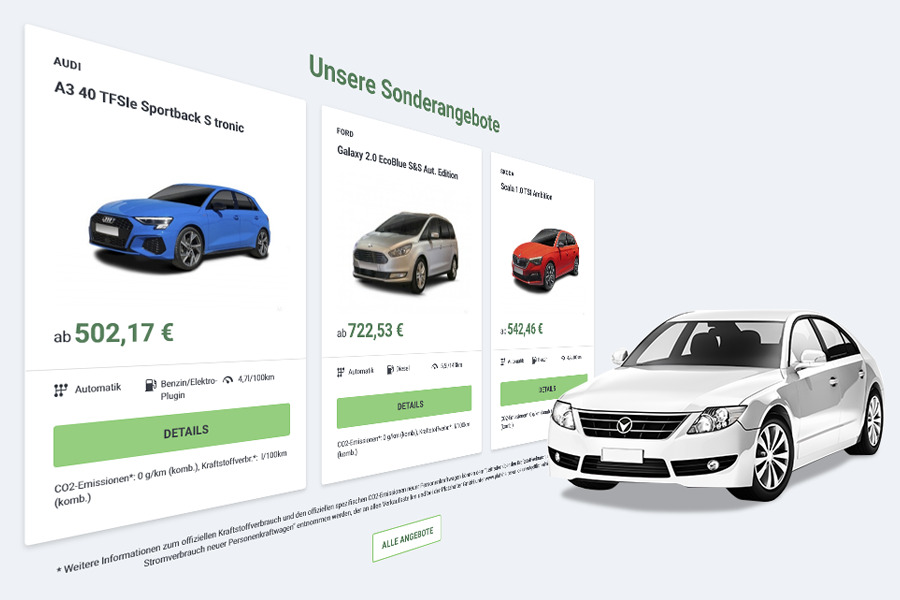

The right vehicle for every fleet : Commercial leasing with Fleethouse

You will soon find attractive leasing offers from our partners here!

A new company car in just a few steps: How company car leasing works with Fleethouse

The procurement of new vehicles is complex and usually involves a great deal of effort. Offers have to be obtained and compared, contracts negotiated at length. Fleethouse digitizes commercial leasing. For you, this means that everything is transparent and clear from the very first click.

Select a suitable vehicle

Compare the attractive range of storage vehicles on offer and select the right model for your fleet.

Make a leasing request

You then decide on the desired leasing conditions and send the leasing request with one click.

Receive company vehicle

The transfer of the car is handled by our partners. You don’t have to worry about anything and will be informed as soon as your new leased vehicle is ready for delivery.

Fleethouse digitizes company car leasing

Gone are the days when fleet managers had commercial leasing offers sent to them by various dealers. Whether you are an SME, a business or a sole proprietorship, digital company car leasing is the ideal way to procure suitable company vehicles for your fleet and keep your employees mobile. Instead of committing to a vehicle for a long time by purchasing it, business leasing offers more flexibility. In combination with the Fleet Management module from Fleethouse, you can keep an eye on all costs and deadlines relating to your vehicles. This means you won’t miss any important deadlines and can find out exactly where costs can be saved in your fleet.

Fast availability of commercial leasing offers

Do you need a vehicle quickly? No problem. Thanks to the large selection of stock vehicles, you can easily and conveniently find the ideal model for your fleet. Whether electric vehicle, van or SUV – you choose what suits your company best and determine the length of the term. This is usually between 12 and 48 months. At the end of the leasing period, the vehicle can be exchanged for another model with new equipment and the latest environmental standards. This minimizes maintenance and repair costs and keeps the fleet up to date.

Transporter leasing made easy

If you need a powerful, reliable van for your fleet, then Fleethouse is the right place for you. You can also find attractive van leasing offers for your business on the fleet platform. Nothing changes in the process: you select the right offer, confirm the order and receive a notification as soon as the van is ready for delivery. At the end of the leasing contract, you can simply exchange the van for a newer model, for example one with lower fuel consumption or lowerCO2 emissions.

Why is commercial leasing with Fleethouse worthwhile?

Leasing company cars is a particularly attractive form of financing for SMEs and tradespeople. The term of the leasing contract creates a fixed framework for how long the vehicle is owned by the company. The monthly installments promise cost stability and are easy on the budget. In contrast to buying a vehicle, equity is not reduced when leasing, which is an important advantage for small companies in particular. You can also deduct the monthly leasing installments and insurance costs as business expenses for tax purposes. This reduces the profit to be reported and your tax burden.

Leasing company cars for small businesses and start-ups

Leasing is an attractive form of financing, especially for small businesses, start-ups and the self-employed. Liquidity is protected, costs can be planned and leasing guarantees more flexibility than buying a vehicle. However, small businesses and start-ups should note that proof of creditworthiness is required when concluding a leasing contract. These include a business management analysis (BWA) and a positive Schufa credit report. Anyone who cannot provide a BWA usually has to pay a deposit or down payment or provide proof of a guarantee. In addition, the business must have existed for at least six months, in some cases even for 12 months.

Everything under one roof: The complete package for your fleet

Would you like to be even more flexible and simply subscribe to the right company car? Then our Modul Auto subscription is just right for you. You can manage all vehicles with the fleet management module. Our UVV driver instruction module is available for the safe instruction of all employees. You can book the individual modules at any time.

Car subscription

Subscribe to the right company car with just a few clicks. With our partner FINN, we offer you a comprehensive mobility package.

Fleet management

A clearly organized fleet thanks to cost, schedule and claims management in the digital vehicle file.

Company car configurator

Conveniently design the equipment for your company vehicle with our configurator and obtain the conditions from your trusted dealership.

Driver's license check

With liva, regular driver’s license checks become the central component of a safe fleet and are carried out digitally, efficiently and transparently.

UVV driver training

Flexible, transparent and audit-proof training for your drivers on fleet safety topics in our e-learning program.

Corporate car sharing

Booking, return and owner liability: comprehensive management of your pool vehicles with our car sharing software.

Frequently asked questions from our customers

The leasing of company cars is a financing method that can only be used by commercial customers. It is also known as corporate leasing or business leasing. Instead of buying a vehicle, the lessee rents it for a fixed period of time. This is usually between 12 and 48 months. In return, the lessor receives a fixed monthly installment.

Leasing offers companies a number of advantages, especially from a financial point of view. Unlike the purchase of a company vehicle, there is no need to make a large investment all at once. Instead, fixed monthly installments provide a predictable basis for calculation and leave a buffer for other expenses. The leasing installments and the necessary insurance can also be deducted from tax as current operating expenses.

If the company car is also used privately, the employee must pay tax on the non-cash benefit. You can choose between flat-rate taxation, the so-called 1 percent rule, or keeping a logbook. In the first variant, a flat rate of one percent of the gross list price of the vehicle is added to the monthly income tax. Which option is more advantageous depends on the individual situation.

In general, a distinction can be made between two types of leasing: mileage leasing and residual value leasing. With mileage leasing, an upper limit is set for the number of kilometers that may be covered within the term of the contract. An additional payment is due for excess mileage; shortfall mileage is reimbursed. The residual value risk of the vehicle then lies with the lessor. With residual value leasing, a residual value is set which the company car must have at the end of the term. The monthly leasing rate is calculated on this basis.

Leasing is an attractive form of financing, especially for small businesses, start-ups and the self-employed. Liquidity is protected, costs can be planned and leasing guarantees more flexibility than buying a vehicle. However, small businesses and start-ups should note that proof of creditworthiness is required when concluding a leasing contract. These include a business management analysis (BWA) and a positive Schufa credit report. Anyone who cannot provide a BWA usually has to pay a deposit or down payment or provide proof of a guarantee. In addition, the business must have existed for at least six months, in some cases even for 12 months.

Private leasing of vehicles usually seems more expensive than commercial leasing. The reason for this is usually the tax advantages from which business customers benefit. They can deduct the leasing installments from their taxable profit as operating expenses. If you deduct the tax savings from the leasing costs, then commercial leasing is cheaper than private leasing. In addition, companies often lease not just one vehicle, but several. This is why retailers often grant volume discounts.

For commercial leasing, you need an active business, an entry in the commercial register (depending on the type of company), a tax number and sufficient creditworthiness. Fleethouse will check this information as part of the inquiry.

From small cars and vans to electric cars – almost all vehicle types can be used in commercial leasing. Models with a low list price, low emissions and high efficiency are particularly popular.

Yes, many commercial leasing offers are also available without a down payment. Whether with or without a special payment – Fleethouse offers flexible conditions, depending on the needs and creditworthiness of the company.

At the end of the term, you usually have the option of returning the vehicle, leasing a new model or – depending on the contract – taking over the car at a residual value.

Our support team is there for you: Vehicle procurement without much effort

Expanding the fleet does not have to be difficult. Register now and be the first to find out when you can configure, finance and order your vehicles with Fleethouse in just a few steps.

"*" indicates required fields