On the pedals, get set, go! Company bikes are an environmentally friendly mobility option that relieves traffic congestion and reduces air pollution in urban areas. They are also a good alternative to cars for companies and employees. But what exactly is a service bike and why is it a good choice? In this article, we give you a comprehensive overview of the company bike and its many possible uses. We also show you the advantages of a company bike for employees and employers and give you tips on how to successfully introduce company bikes for your company.

Contents

What is a company bike?

A company bike is a bicycle that is provided by the employer and may generally be used by the employee for business and private purposes; both for short trips between home and work and for business trips. There are different types of company bikes, including city bikes, cargo bikes and mountain bikesopen_in_new , which can be selected according to the needs of the company and the employees. E-bikesopen_in_new can also be used as company bikes.

What are the advantages of a company bike?

For employees

- Regular exercise: Whether on the way to work, in your free time or for short business trips – the company bike offers a practical way to integrate more exercise into your everyday life.

- Cost savings: Costs for fuel, parking fees and public transportation can be reduced through regular use of the company bike. Charging electric bicycles at the employer’s premises is also tax-privileged.

- Tax advantages: If employees receive the company bike in addition to their salary, the non-cash benefit remains tax- and contribution-free.

- More flexibility: Traffic jams and closures on the way to work can be avoided more easily by bike. This provides more flexibility and can save time.

For employers

- Environmentally friendly commitment: With company bikes, companies can help to reduce environmentally harmful emissions and make an active contribution to climate protection. In this way, you can show your commitment to environmental protection.

- Positive incentive for employees: Company bikes can be a valuable incentive for employees, while health and well-being can lead to increased productivity.

- Reducing the tax burden: Companies can claim company bicycles as a business expense and thus further reduce their tax burden.

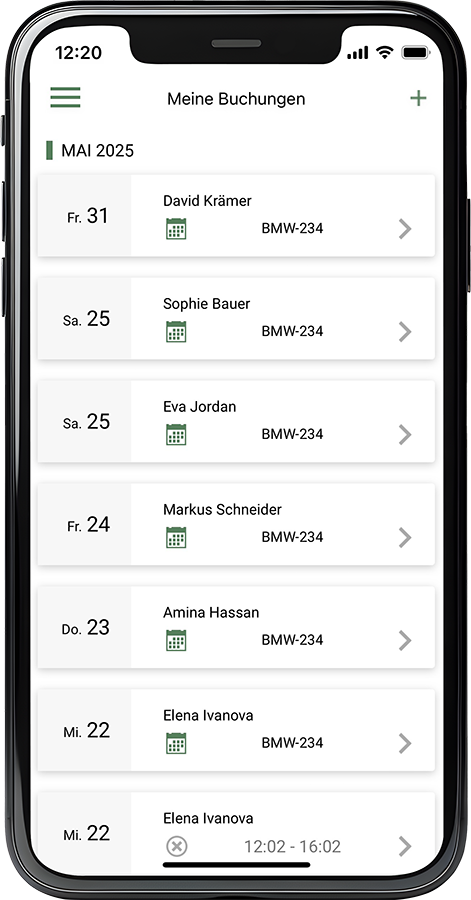

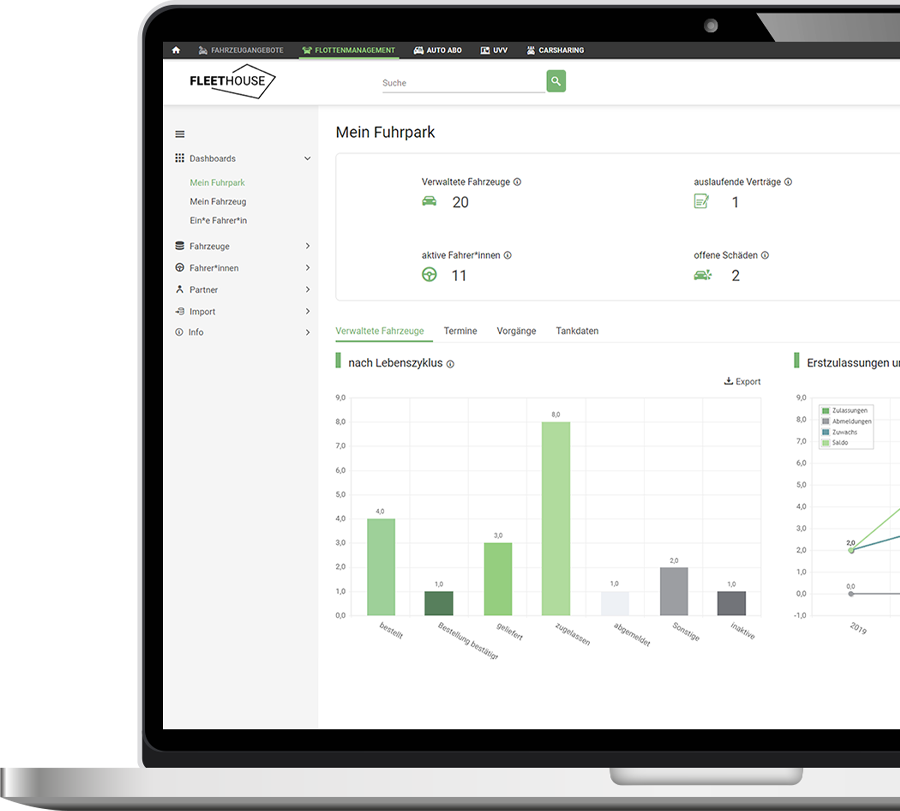

Organize your company bikes

With the Fleethouse fleet management module, you can manage company bikes, assign leasing contracts and keep an eye on all service appointments.

Company bike leasing

When leasing company bikes, an external provider assumes the acquisition costs and makes the bikes available to the company. The employee then often selects a suitable bike from an authorized dealer of the lessor. The employer can limit the selection options to certain models beforehand, similar to the framework conditions of a car policy.

The company pays a monthly leasing rate for the use of the bike, which often also covers maintenance and insurance costs. The monthly leasing rate depends on the selected model and insurance rate. As a rule, leasing contracts run for three years. This allows companies to enjoy the benefits of a company bike without having to pay the entire purchase price at once. The leasing costs can be claimed against tax over time.

A major advantage of leasing bicycles is the flexibility. Companies can also choose other terms for a leasing contract, whether for a specific period or as part of an employee benefits program. They can also choose from a wide range of bike models to suit the individual preferences and requirements of their employees.

In the event of damage or defects, the lessor is responsible for repairing the bicycle. Some tariffs also cover accidents and theft. Some providers also offer a breakdown assistance service. The monthly leasing rate depends on the selected model and insurance rate.

Purchase of the company bike at the end of the leasing period

The lessor often offers the used bike for sale. However, caution is advised when purchasing a company bike at the end of the leasing period , as the difference between the residual value and the used purchase price must be taxed. As a rule, only a residual value of ten percent of the original purchase price has been applied to date.

In 2017, the tax authorities therefore decided to assess the residual value of a company bicycle after 36 months of the contract term at a flat rate of 40% of the recommended retail price at the time the bicycle is put into service, including VAT. The taxable non-cash benefit thus increases to 30%.

Company bike Monetary benefit and 0.25 percent rule

The non-cash benefit of company bicycles is an important aspect that affects both employees and employers. If a company provides its employees with company bicycles, this can be treated as a non-cash benefit and added to the employee’s taxable income . The decisive factor here is whether the employee receives the company bike in addition to their salary or as deferred compensation.

If the employee receives the company bike, which they can also use privately, in addition to their salary, this has been tax and contribution-free since the beginning of 2019. Initially, the tax concessions were limited to three years. They now apply to company bikes that were provided for the first time between 2019 and the end of 2030.

In the more common case, the employee waives part of their salary in the amount of the leasing installment for the duration of the leasing of the company bike. A salary conversion takes place. If the company makes the company bike available for the first time until the end of 2030, a tax concession also applies here. Since 2020, the monthly value of the bike rental has been 1 percent of a quarter of the recommended retail price (rounded down to the nearest 100 euros). In fact, this corresponds to a tax rate of 0.25 % open_in_new .

Example:

- List price company bike = 2,500 euros

- Of which ¼ = 625 euros

- Amount rounded down to the nearest 100 euros = 600 euros

- Monetary benefit (1 percent) = 6 euros

In the above example, the employee must pay EUR 6 per month as a non-cash benefit for a company bicycle with a list price of EUR 2,500.

E-bike as a company bike

Electric bikes can be used as company bikes in the same way as other bikes. Due to the higher purchase price of an e-bike, the tax benefits and possible additional leasing components such as insurance and repairs are particularly interesting. Charging electric bicycles at the employer’s premises is also tax-privileged.

Please note the difference between electric bicycles and pedelecsopen_in_new . Fast pedelecs (S-pedelecs), which can travel up to 45 kilometers per hour, are classified as motor vehicles. Therefore, similar regulations apply to them as to an electric company car. In this case, the journeys between home and the first place of work must also be taxed as a non-cash benefit at 0.03% of the purchase price per kilometer. Alternatively, the company can tax the costs of commuting at 15 percent. However, the employee can then no longer claim a commuting allowance. In addition, S-Pedelecs are subject to insurance, license plate, driving license and helmet requirements.

Find out more about employee mobility in our free guide: Organizing employee mobility successfully

More safety in the fleet?

Instruct your drivers in the safe handling of vehicles and how to behave in the event of accidents via an e-learning course.

How can companies introduce company bikes?

- Leasing option: Check which leasing provider offers the best conditions and a suitable concept. There are also specialized providers here, such as the Jobradopen_in_new .

- Infrastructure: What infrastructure is required? Are you willing and able to offer secure parking spaces, charging facilities for e-bikes and, if necessary, changing rooms or showers?

- Safety: It is important to support employees in the use of company bicycles, for example through bicycle safety training or the provision of bicycle helmets and other accessories. You are also obliged to provide instruction in accordancewith the accident prevention regulations § 70open_in_new .

- Internal communication: A successful introduction of service vendors requires sensitization of employees. Communicate the benefits of a company bike and motivate employees to take advantage of this offer. Information events and individual consultations can be helpful.

- Evaluation and adjustment: It is important to regularly evaluate the use of company bikes and respond to employee needs and feedback Companies should be open to feedback and make adjustments as necessary to ensure that the company bike program is effective and successful.

The most important facts about the company bike

The company bike offers numerous advantages for employees and employers in companies, also with regard to tax issues.

It is an environmentally friendly, cost-effective and health-promoting mobility alternative that can increase employee motivation.

By using a leasing offer, even small companies can benefit from these advantages without having to make large investments.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

Taxing company cars: requirements and tax advantages

Car allowance or company car: advantages & disadvantages