Contents

1 percent rule: Definition

If employees are also allowed to use their company car privately , a non-cash benefit arises. According to Section 8 of the German Income Tax Actopen_in_new , this non-cash benefit is income that the employee must pay tax on. This can be done on a monthly basis using the 1 percent rule and is therefore much easier to handle than a logbook, for example.

How can you apply the 1 percent rule?

Taxation is based on 1 percent of the gross list price of the vehicle in Germany at the time of initial registration. The gross list price is the new price of the vehicle and also includes all optional extras. Neither the actual purchase value nor the age of the vehicle play a role. You must therefore always use the new price, even if you drive an older or used company car.

Calculation example:

- Taxable income (excluding company car): 3,200 euros

- Gross list price company car: 37,000 euros

Gross list price x 0.01 = 37,000 euros x 0.01 = 370 euros

1 percent rule: It does not apply in these cases

The 1 percent rule is not the right method in every case. In certain cases, other rules apply to taxation or it is worth using alternatives. Some of these cases are listed here:

- Short-term use: If you only use the company car privately for a short period of time, you only have to pay tax on part of the non-cash benefit. This is the case, for example, if you only use the company car for a few days or weeks. The non-cash benefit is then taxed on a daily basis.

- No private use: If you do not use the company car privately, there is no non-cash benefit. Therefore, you do not have to pay tax on the company car according to the 1 percent rule.

Use of a company car - Alternative: You can also record your private and business journeys in a logbook. This allows you to avoid the flat-rate taxation according to the 1 percent rule. This method is particularly worthwhile if you only make a few private journeys with the company car.

1 percent rule: Additional taxation of journeys between home and work

Many employees also use their company car on the way between work and home. If this is the case, you must pay additional tax on top of the 1 percent rule. In this case, you must pay tax on an additional 0.03% of the gross list price per kilometer driven as a non-cash benefit.

Calculation example

- Taxable income (excluding company car): 3,200 euros

- Gross list price company car: 37,000 euros

- Commute: 30 kilometers (on 20 days)

Gross list price x 0.01 = 37,000 euros x 0.01 = 370 euros

As well as

37,000 euros x 0.0003 x 20 = 222 euros

Total monetary benefit: 370 euros + 222 euros = 592 euros

Always mobile with the car subscription

Lower non-cash benefit for fewer than 15 journeys between home and work

Anyone who drives a company car to work less than 15 days a month must pay tax on a lower non-cash benefit. Employees benefit from a tax rate of 0.02 percent per day.

Calculation example:

- Taxable income (excluding company car): 3,200 euros

- Gross list price company car: 37,000 euros

- Commute: 30 kilometers (on 10 days)

Gross list price x 0.01 = 37,000 euros x 0.01 = 370 euros

As well as

37,000 euros x 0.0002 x 10 = 74 euros

Total monetary benefit: 370 euros + 74 euros = 444 euros

Does the 1 percent rule also apply to hybrid and e-vehicles?

If you drive a company car with an electric drive, the 1 percent rule only applies to you to a limited extent. Instead of 1 percent of the gross list price, you only have to pay tax on 0.5 percent as a non-cash benefit.

In addition § Section 6 para. 1 No. 4 Sentence 2 No. 3 EStG From 2020, the German tax law provides for a further benefit for electric vehicles purchased or leased between December 31, 2018 and January 1, 2031. If the list price of your electric vehicle is less than 60,000 euros, you only have to pay tax on 0.25 percent of the gross list price as a non-cash benefit.

From 2024, the limit for vehicles purchased after December 31, 2023 will even be raised to 70,000 euros. Only 0.03% of the quartered list price will also have to be taxed for journeys between home and work. This regulation also applies to hybrid vehicles.

Calculation example:

- Taxable income (without e-company car): 3,200 euros

- Gross list price e-company car: 37,000 euros

- Commute: 20 kilometers (20 days a month)

37,000 euros x 0.25 x 0.01 = 92.50 euros

and

37,000 Euro x 0.25 x 0.0003 x 20 = 55.50 Euro

Total monetary benefit: 92.50 euros + 55.50 euros = 148 euros

The calculation example makes it clear that an employee with an electric company car has to pay tax on a significantly lower non-cash benefit than with a company car with a combustion engine for the same use. The taxable income when using an electric company car is 3,348 euros – that is 444 euros less than for a company car with a combustion engine. E-cars can therefore be an attractive alternative. E-company cars not only cause fewer emissions, but also save taxes.

What are the advantages and disadvantages of the 1 percent method?

The 1 percent rule for the taxation of company cars has advantages and disadvantages. There are therefore some important points to bear in mind:

Advantages

- Simple application: As the non-cash benefit is calculated as a lump sum, there is no need to keep a time-consuming logbook. This reduces the administrative effort and saves time if you frequently use your company car privately.

Attractiveness for - Frequent users: If you use your company car frequently, you benefit from the flat-rate regulation, as it applies regardless of the actual mileage.

- Clear calculation: Thanks to the flat-rate system, both employee and employer know the exact amount of the taxable non-cash benefit, which enables precise cost planning.

Disadvantages

- Excessive tax burden: If you only rarely use your company car privately, the flat rate can place an excessive financial burden on you, as it does not reflect actual use.

- High tax costs for expensive vehicles: For particularly expensive company cars, flat-rate taxation can lead to high monthly tax payments, even if you hardly use the vehicle privately.

Do you want to give Excel the boot?

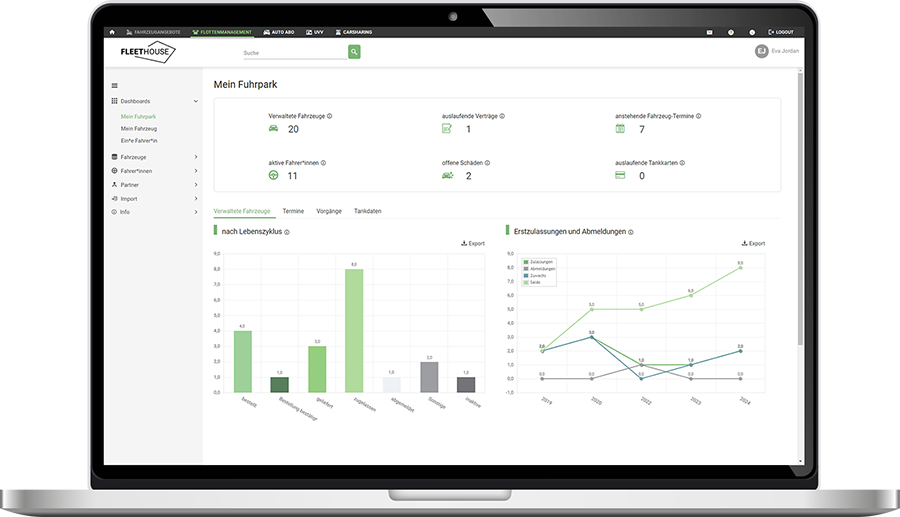

Register with Fleethouse and manage your company vehicles completely digitally.

The most important facts about the 1 percent rule

The 1 percent rule is a simple method of taxing company cars at a flat rate.

Drivers of electric company cars benefit from a lower tax burden, as they are taxed at 0.25 percent.

In addition to the 1 percent rule, there is also the method of documentation in a logbook. This can be a cheaper alternative if you rarely use the vehicle privately.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend this article.

Taxing company cars: requirements and tax advantages