Claims handling is part of everyday working life for fleet managers, because accidents happen to even the most experienced drivers. And if damage occurs to the company car, it must be dealt with quickly and professionally. Because every day that a car in the fleet is not ready for use costs money and impairs work processes. In this article, you will learn how to efficiently organize claims processing in your fleet and what steps you need to take.

Contents

What does claims settlement mean?

Claims handling is the systematic recording and processing of damage that has occurred in the course of an operational activity – from reporting the damage to the insurer through to repair and settlement. Claims handling also includes communication with the parties involved, such as fleet insurance, workshops or service providers.

The aim of claims settlement in the vehicle fleet is to resolve the claim quickly and efficiently in order to minimize economic damage and resume normal business operations as quickly as possible.

Effective vehicle claims processing can be optimized through careful preparation and clear process planning.Digital claims processing in the vehicle fleet with the help of a software solution can be a great support here and help to make the process more effective and transparent.

Measures for claims settlement in the vehicle fleet

Claims handling follows a series of steps to minimize costs and get employees back on the road as quickly as possible. It therefore requires a clear schedule and includes the following measures:

- Accident documentation: The driver should first record the data of all parties involved in the accident and document the course of the accident open_in_new . The European Accident Report open_in_new can be used as a template for this. The form is standardized throughout Europe and contains all information that is relevant for the settlement of the claim. Pictures of the accident site and the vehicles are also very helpful as evidence. In the event of an accident involving a company car, the police should always be informed. They will draw up an accident report on site.

- Damage assessment: Gather all information and documents on the course of events and the amount of damage. This includes photos of the scene of the accident, witness statements and the completed accident report. This is also important for the insurer.

- Reporting a claim to the insurance company: The claim should be reported as soon as possible after the damage has occurred and should include all relevant information and documents. The insurance company will then check whether the damage is covered by the insurance and which sums insured and deductibles are relevant.

- Repair: Obtain a cost estimate from a garage and then make an appointment for the repair of the company vehicle. If the employee is dependent on a company car, you should provide a replacement vehicle.

- Clarify the question of liability: The degree of negligence is decisive when it comes to who is liable in the event of an accident involving a company car.

- Cost control and analysis: Monitor all costs during the entire claims process and compare the repair invoices with the cost estimates. The evaluation of damage costs and the most frequent causes of damage gives you useful insights into the vehicle fleet and helps you to identify causes and avoid future damage.

- Accident prevention and aftercare: regularly instruct your drivers in accident prevention and road safety. With the UVV driver training as an e-learning course, employees can complete the training flexibly. The course content has already been fully prepared and all test results are fully documented.

Digital claims processing using fleet software

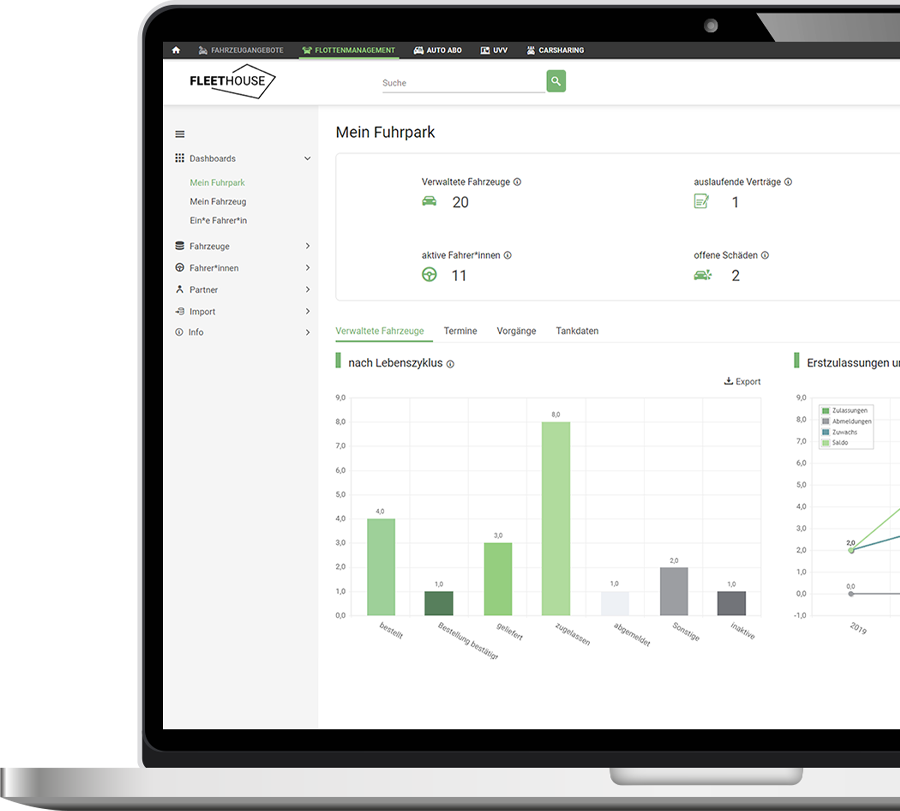

Fleet management software such as Fleethouse can support the processes involved in vehicle claims handling. Such software records all steps from accident recording to repair and helps to maintain an overview when communicating with insurance companies. In addition, a digital solution enables claims to be processed more quickly, thus reducing the downtime of damaged vehicles.

With the help of software, all information and documents can be managed digitally and retrieved quickly and easily if required. Such a platform can be a great relief for those responsible in the fleet, as it simplifies and accelerates the entire process from damage assessment to repair organization and settlement with the insurer.

However, digital claims processing not only optimizes the process flow, it also reduces costs. Fleet software enables precise cost calculation and thus prevents unnecessary expenditure. The software can also be used to simplify and coordinate regular checks and inspections in order to minimize future damage.

Fleet Management

Organize all tasks relating to your vehicles with Fleethouse, including claims management.

The most important facts about claims management at a glance

In the event of damage to a company car, it is very important to settle claims quickly and correctly in order to avoid unnecessary costs and disrupt operational processes as little as possible.

In addition to documenting the accident and reporting the claim to the insurance company, claims handling also includes cost control and analyzing common causes of damage.

Digital claims processing optimizes the processes involved in handling claims and simplifies communication with the insurance company.

Further Fleet Knowledge

If you liked this article and would like to know more about this topic, we recommend these articles.

Accident with company car: Who pays?